You are here

Sat, 2013-10-05 16:16 — mdmcdonald

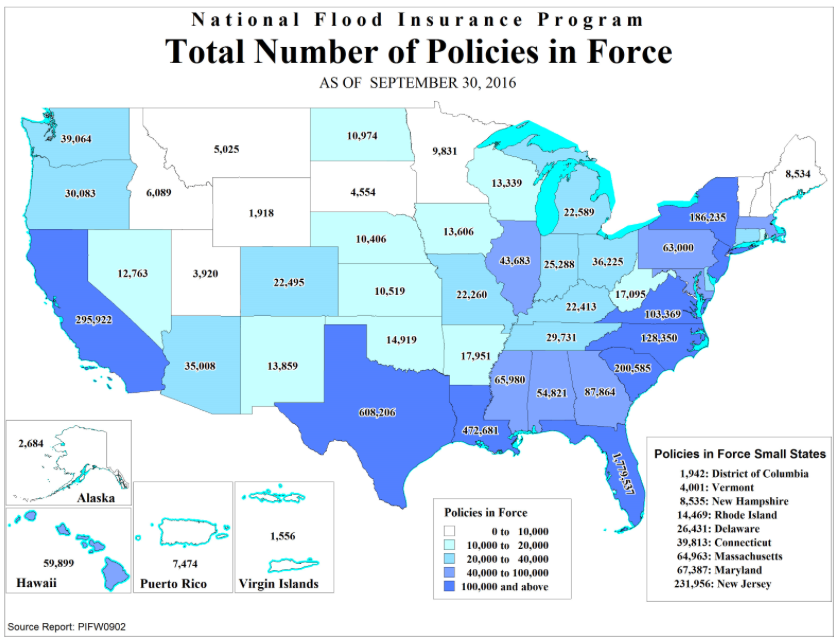

This group focuses on the insurance industry's response to the increasing number of natural events and how this response impacts Americans.

This group focuses on the insurance industry's response to the increasing number of natural events and how this response impacts Americans.

Add Content to this group

Members

| mdmcdonald | WDS1200-Columbus |

Email address for group

insurance-us@m.resiliencesystem.org

Recent Comments